Overlapping transaction time is the time with the highest liquidity.

The foreign exchange market is more active than the stock market and is traded in the form of OTC, which means that currency pairs are not listed on any exchange. Although most foreign exchange is traded in London, New York and Tokyo, there is no major trading city. This is the real global market. Compared with other markets, foreign exchange is favored by individual investors because of its high liquidity. You can conduct foreign exchange transactions anywhere through the Internet. Foreign exchange traders seek the profit of price difference by buying and selling a currency that is rising or falling relative to other currencies. Foreign exchange traders usually benefit from price fluctuations caused by high liquidity and a large number of buyers and sellers. Foreign exchange prices are affected by macro factors. For example, the latest decision of the central bank will have a more direct impact on the foreign exchange market than the stock market. You only need to evaluate whether one currency is more valuable than the other.

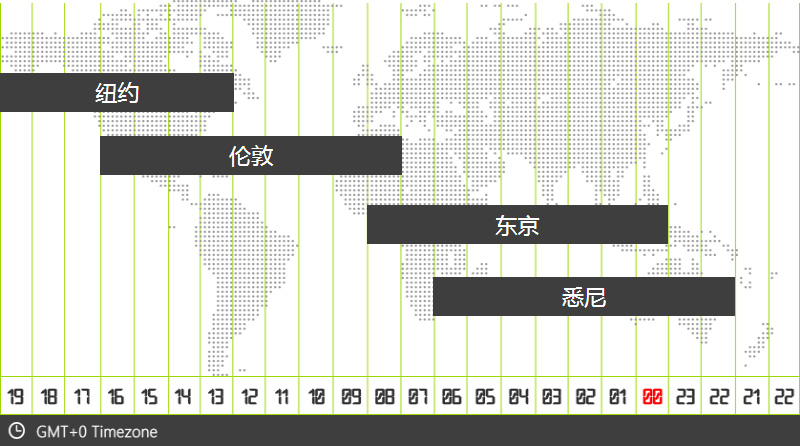

The foreign exchange trading time in New York is from 21:00 to 06:00 the next day.

The foreign exchange trading time in New York is from 21:00 to 06:00 the next day.

London foreign exchange trading time is from 16:00 to 01:00 the next day.

London foreign exchange trading time is from 16:00 to 01:00 the next day.

The foreign exchange trading time in Tokyo is from 08:00 to 17:00.

The foreign exchange trading time in Tokyo is from 08:00 to 17:00.

Sydney foreign exchange trading time is from 06:00 to 15:00.

Sydney foreign exchange trading time is from 06:00 to 15:00.

London & New York [21:00 - 01:00] GMT+8

London & New York [21:00 - 01:00] GMT+8

Tokyo & London [16:00 - 17:00] GMT+8

Tokyo & London [16:00 - 17:00] GMT+8

Sydney & Tokyo [08:00 - 15:00] GMT+8

Sydney & Tokyo [08:00 - 15:00] GMT+8